Investment in densely populated megapolitan areas will drive future supply chain efficiencies and cost savings

by Carol Miller, MHI VP of Marketing and Communications

As the globalization and complexity of supply chains advance, so must its optimization, especially for companies that process freight shipments between the U.S. and Asia.

These companies are heavily scrutinizing transportation costs in East Coast and West Coast seaports—and inland cities with strong transportation links—locating facilities in markets best able to serve established and emerging “megapolitan” areas in a quick, cost-effective manner, according to the latest report from CBRE Group, Inc., Transportation Cost Equivalence Line: East Coast vs. West Coast Ports.

This report makes it clear that to maximize supply chain efficiency, distribution center locations that are within close proximity to U.S. population clusters and multi-modal transportation are crucial. The report suggests that firms should first determine the optimal location based on their outbound requirement (buyers, people and retail locations) and then place their facilities as close as possible to transportation infrastructure based on their inbound requirements (cargo port, inland ports and rail).

“Future location decisions will largely be driven based on population growth—the East Coast and West Coast ports with the infrastructure and transportation links to serve the largest and fastest growing regions in the country will also be home to strong-performing industrial real estate markets,” said Scott Marshall, Executive Managing Director, Industrial Services, Americas, CBRE.

“Significant and ongoing investment in Florida’s seaports, airports and intermodal transportation infrastructure is driving industrial development throughout the state and attracting investors and businesses to the region,” said South Florida Managing Director Ken Krasnow.

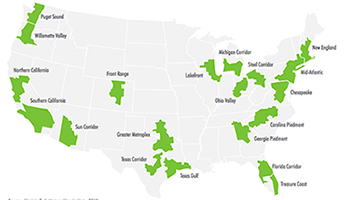

Between 2005 and 2040, the U.S. population is expected to grow by 100 million people—60 million of which are expected to reside within 20 markets characterized as megapolitans. These megapolitan markets comprise cities and counties linked by shared transportation networks, labor markets and/or water supplies. These 20 megapolitan areas, which can be further combined into 10 clusters, are projected to house about two-thirds of the U.S. population by 2040 and will capture the lion’s share of total investment dollars spent on development and growth.

According to projections by the Florida Bureau of Economic and Business Research, North Florida’s population is expected to increase by 1.2 million people, or 31%, between 2013 and 2040, while Central Florida’s population is expected to increase by 2.7 million people, or 39%, and South Florida’s population is expected to increase by 2.4 million people, or 29%. The impact of population shifts on supply chain networks and industrial real estate in the coming years will be significant.

However, the additional volume moving through these megapolitan regions could result in increased congestion and loss of productivity. As such, the continued investment in transportation infrastructure is crucial.

Impact of Panama Canal Expansion

In order to capitalize on the greater container volume that will soon traverse the expanded Panama Canal, many seaports have recently invested millions in infrastructure, creating alternative transportation solutions including short haul rail and barge systems to accommodate post-Panamax ships. However, according to the report, the expansion of the Panama Canal is not expected to have a major impact in the movement of freight within the U.S., as separate strategies are required for high-value, time-sensitive freight (quicker delivery) and for low-value, low-cost freight (cost effective delivery).

Click here to download the complete report.